Data Assessment and Initial Strategy Implementation

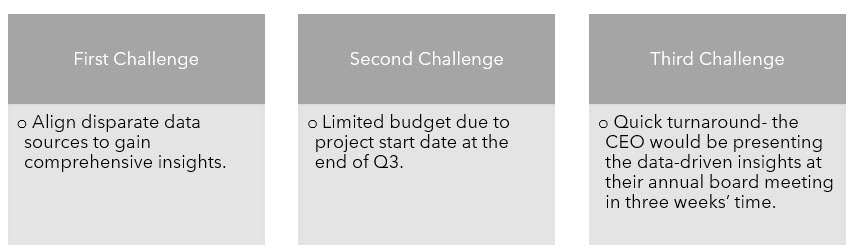

Challenge

Belchim Crop Protection USA, LLC (Belchim), an agrochemical/biological company wanted to explore the opportunity to move forward with a more datacentric approach to support an enhanced understanding of their customers, the market, and their opportunities for growth.

Belchim was interested in doing an initial investigation of their key data sources to identify business insights and recommendations related to leveraging data to inform future strategies.

Available data sources included multiple years of customer sales data, information on product sales, and contact data for retailers and growers, along with various sources of market data.

Approach

In order to evaluate the current state of Belchim’s data capabilities, SIGMA recommended a data assessment be conducted. This data assessment would not only provide Belchim with an understanding of their data but also allow the SIGMA team to lead Belchim stakeholders through a proof-of-concept project managed by SIGMA.

The initial step of the data assessment was to align Belchim’s customer sales and contact data. Once the data sources were aligned and reviewed for factors like data quality and percentage complete, SIGMA Data Scientists worked to determine key insights. Key insights and findings were visually presented to Belchim stakeholders with recommendations for next steps.

Results

Through the data assessment SIGMA was able to provide two significant recommendations for next steps in the Belchim data journey.

Customer Attrition Strategies

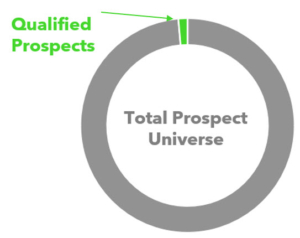

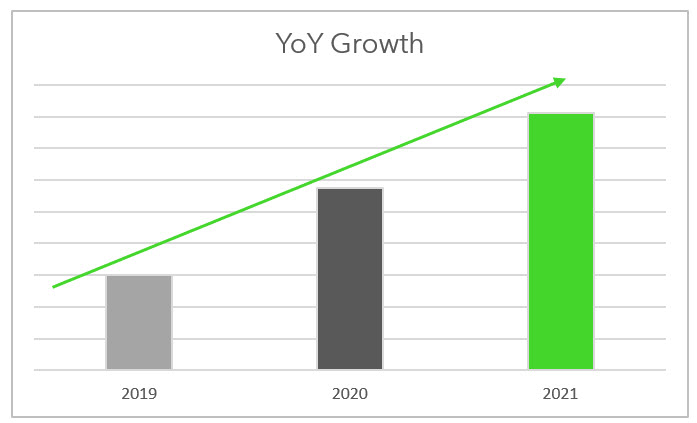

Belchim’s available data helped SIGMA determine that although sales are increasing year over year, the number of unique customers is not increasing. This finding provides insight that although the Belchim team is excelling at growing sales for current customers, they need to focus on gaining new customers.

The SIGMA team made recommendations to adapt strategies to combat attrition while leveraging current practices to improve customer retention.

Implement Data Mart and Visual Dashboards

An analysis of Belchim’s data sources helped to determine the need for Belchim to work towards implementing a centralized data mart. The data mart would allow Belchim to combine disparate data sources for the specific purpose of driving learnings to enhance Belchim sales efforts.

The data mart would also invite Belchim to begin collecting additional data for deeper insights. As a result, the data mart would also serve to feed visual dashboards, developed by the SIGMA team to disseminate findings to the Belchim sales team to begin leveraging retail data to connect sales representatives at a tactical level.

Initial Implementation

Following the data assessment, Belchim has begun to implement some of SIGMA’s recommendations like a cohesive data mart and visual dashboards. Tom Wood, General Manager at Belchim Crop Protection USA, LLC stated that

“SIGMA’s ability to accumulate large amounts of data from a variety of sources and put it in a workable design (dynamic dashboards, models, etc.) is impressive. Putting market data into a dynamic database with pull-down options makes our Market Opportunity Assessments easier as well addressing adhoc questions on the markets we compete in easier. Overall, I think we are on the right path with SIGMA, but I think the best is yet to come.”

Belchim Crop Protection USA (“Belchim USA”) is an agrochemical/biological company focused on crop protection and pest mitigation, which leverages the strong innovation and R&D culture of its European parent. Headquartered in Wilmington, Delaware, Belchim USA is one of the only and largest independent crop protection companies, deeply driven toward continuous innovation and commercialization around new products, bringing both conventional and biological products to the Agriculture and Turf & Ornamental industries in the United States. http://www.belchimusa.com