Data Assessment For Strategic Insights

Challenge

An agricultural crop protection manufacturer was looking to determine how their internal data sources could help inform strategic business decisions for the upcoming crop year. The company had been collecting customer and product sales data consistently for a few years but an assessment of the quality and completeness of the data had never been reviewed.

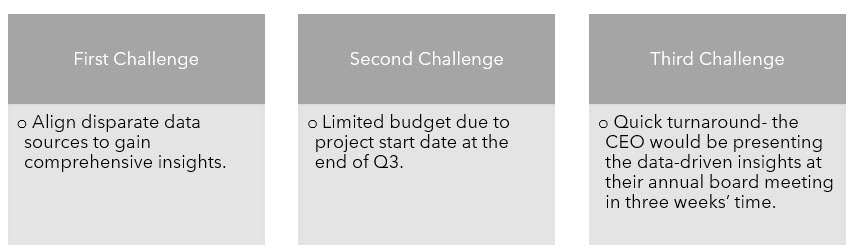

In order to be successful, the company would need to overcome a series of challenges.

Approach

In order to address these challenges in the requested timeline and gain insights quickly, SIGMA recommended an initial data assessment. The objective of the data assessment was to align the company’s key internal data sources to identify insights that the CEO could present at the upcoming board meeting and provide recommendations to leverage those insights to inform future strategies.

Initially, SIGMA Data Scientists reviewed the internal data sources for quality, completeness, and cleanliness. The team worked to align the disparate data sources based on commonalities and unique identifiers to gain initial insights.

Following the initial data work, the team conducted a virtual workshop with company stakeholders. The purpose of a workshop is to allow SIGMA team members the opportunity to share initial findings and for company stakeholders to lend knowledge to outstanding questions. This also allows for a discussion to determine if additional data is available to assist with filling in any gaps.

Results

The data assessment provided the company with a realistic view of the current state of their data along with data-driven insights. Insights shared at the annual board meeting focused on:

Additional insights gleaned from the data assessment showed areas that required a plan of action to address potential issues related to lack of data and customer attrition.

The data assessment showed:

Lack of data: Although the company had been collecting sales data for 2-3 years, the data was not consistent and was only being collected from a small number of distributors. The SIGMA team completed an analysis on the data provided but the data available was not representative of the overall business.

Based on this finding, SIGMA provided a strategy for acquiring additional data that could be incorporated into the current data set for a more complete view. These recommendations included outreach to distributors to collect monthly sales data and investment in external market and competitive data sources.

Customer Attrition: From the data that was available, the SIGMA team was able to determine that at the end of Q2 of the current year, 30% of customers that had made a purchase the previous year, had not yet made a purchase in the current year. An analysis of customer sales data showed that over 50% of those customers that had not made a purchase in the current year were associated with the same distributor. In addition, 30% of those non-repeat customers had previously purchased the same product.

These insights prompted SIGMA to work with company stakeholders to develop a plan for a more in-depth customer performance analysis. Additional analysis would help the team to:

- Understand the reasons for attribution and help inform engagement moving forward

- Determine commonalities among those customers who did not have repeat purchases to understand potential attrition drivers (location, product/technology, purchase timeframe, distributor)

- Communicate findings to sales teams with a plan for outreach to distributors to collect information (calling campaign, email campaign, onsite visits)

The initial data assessment conducted by SIGMA, provided the company with a clear path forward in terms of current state, recommendations for data collection, and produced valuable customer insights that required additional analysis to potentially win-back sales for the current year.